IQBroker Blocked Account

As a reliable broker platform that allows to work with different kinds of assets, including crypto, IQ Broker supports its reputation of a reliable partner. To prevent any kind of fraudulence through the platform, there can be rare occasions of account banishment. For learning more, this article will present the main reasons for it, general recommendations and answers for frequently asked questions.

Why IQBroker account was blocked?

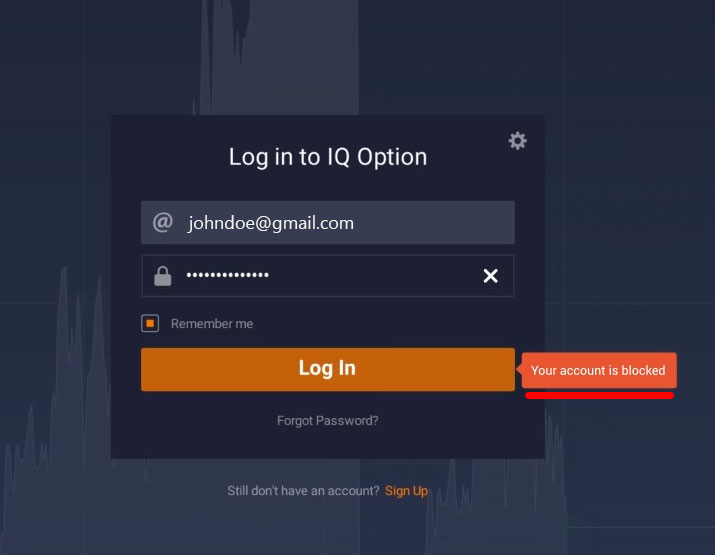

Sometimes, when entering the website or application with the account, the trader can see such pop-up message after clicking the “Log in” button. It is a very rare occasion, but still existent – yes, the IQ Broker platform can block the user’s account. This can happen only for some quite serious reasons, like the following examples:

- Replenishing the balance with the help of someone else’s payment accounts. For the platform, it is essential to have the users pay from their own name, so in cases with unmatching account owner’s name and holder of credit card or e-wallet, it is a serious basis for suspecting fraudulent activity. Once such situations are discovered, the account gets suspended immediately.

- Unnatural behavior of the account. If the user significantly changes the behavior patterns, making the operations never done previously, then the financial department can block the trader and request for e-mail contacting. After the owner confirms the recent actions, the account is unblocked again safely.

- Obtaining multiple accounts on the platform. Having more than one account is prohibited by the official Terms of Use, considered as market manipulation. If the user still gets several accounts under one name, the administration is in right to suspend all the existing profiles.

- Providing the false information about the personal identity. Once the trader lies about the stated age, or if the account is registered on another family member or person, this account gets blocked immediately. Only the actual owner of the documents has the right of working with the IQ Broker platform.

- Requesting to open the real account without providing the personal information. It becomes a serious reason for administration to suspect something is wrong with account owner’s documentation. Such account also gets blocked from continuing the work on the platform.

- Creating the account from USA, Australia, Belgium, Israel, Sudan, Syria, Iran, North Korea or Japan. If the user is a citizen or temporary resident of these countries, then the activity on IQ Broker platform is considered illegal for them, and, to prevent any other inconveniences, such profiles are blocked.

Why IQBroker account was closed?

If one of the rules above was violated, the administration has the full right for blocking the account for not following the Terms of Use. In some of the cases, the warning message is sent to the e-mail address, stating there the intentions for blocking so that the user gets the chance to explain their situation. Once the administration gets the valid arguments about why the rules were not broken, it calls the block back, restoring the account data immediately. The ones who encountered such situation just need to address the issue to the Support team in any of the comfortable means.

How to unblock account?

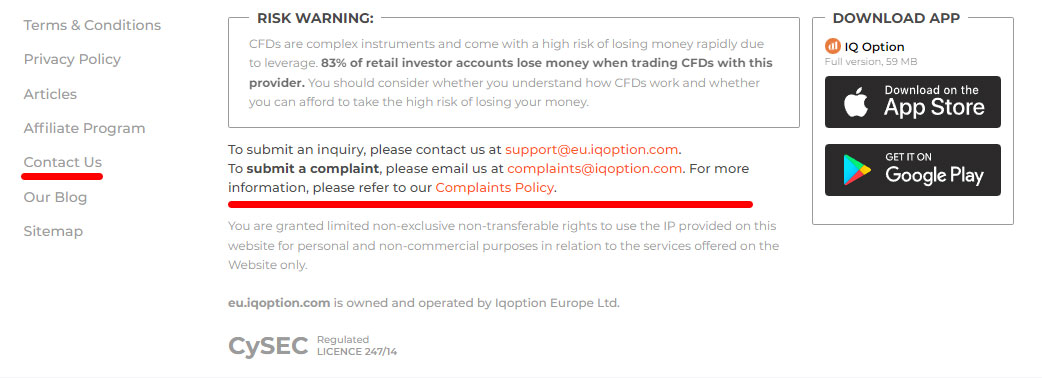

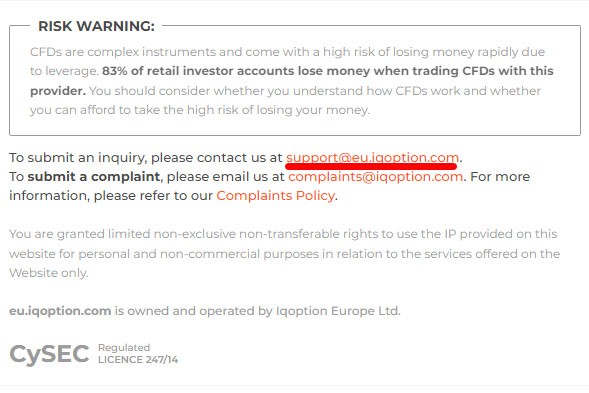

One of the most convenient ways to reach the Customer Support and appeal against the block is to use the in-site feature of “Contact Us”, finding there the relevant e-mail address. After writing the letter, explaining the situation there, the further instructions will be given to get the account back.

How to close account?

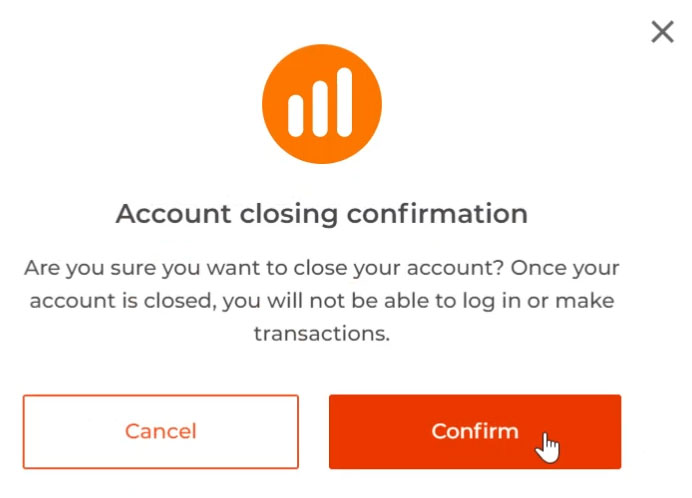

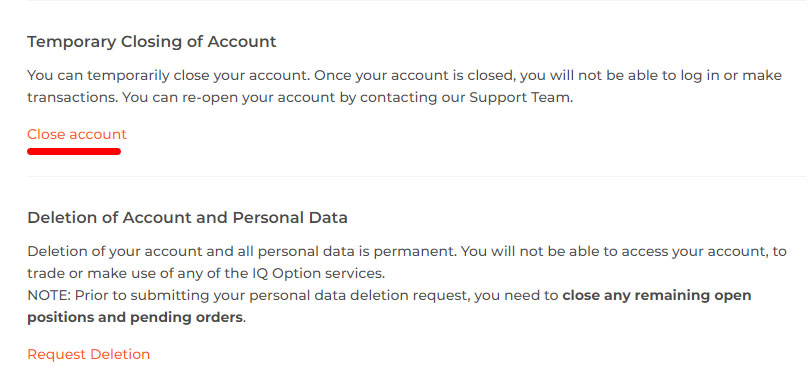

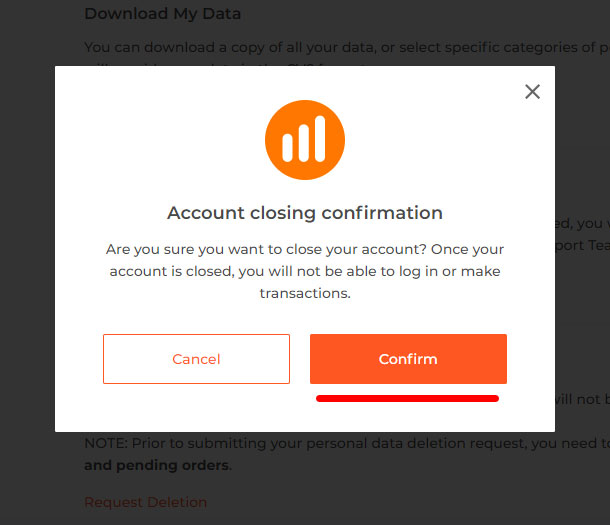

The IQ Broker platform allows its users to manually close the account once there is such need. Only a couple of simple steps is required for stopping the profile activity:

- Find the “Account setting” tab in the menu.

- Select from the list the option with “Temporary closing of Account”.

- Click on the link with “Close account” sign to proceed.

- Confirm the operation.

Can trader open new account?

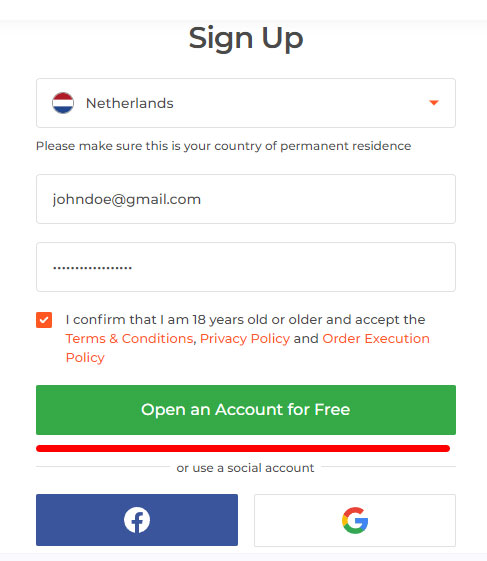

There are two available options for the trader who has the currently closed account – one of them is creating a new profile with another e-mail and settings. It also means the user has to pass the verification once again, applying the documents for a check-up once again.

How to re-open closed account?

Another option for the person with previously active account is to request for reopening it. Such way is only available for users who have selected the temporary close, and their data is only archived, not being deleted completely. Once the decision is made, the letter should be sent to the corresponding e-mail address, which is listed in the “Contact Us” website section.

Traders about issues with trading accounts

The current User Policy is getting praised by many of the active brokers who already have a solid reputation in the community. It is agreed that such rules and applied measures are justified to maintain the fair activity on the IQ Broker platform.

Why should trader close account?

It is fully dependent on a person whether they have to close the account temporarily or opt for the permanent delete. The first option is chosen for taking break from trades, recover from incorrect decisions while still planning to return, helping to keep the account safe during the absence. The second choice is for the people who strictly decide on leaving the trading field, wanting to erase all the information about the activity from the platforms used.

Is IQBroker scam?

Sometimes people state that IQ Broker is scam that fools people for money. Contrary to such talks, the activity of the platform already lasts for more than 8 years, providing the traders with all the instruments for comfortable work. Available in 213 countries, it currently has over 40 million registered users with any level of trading experience. Everybody also gets the opportunity for training, which is supported by special demo account feature and official educational materials for free. All the operations, either with fiat or crypto currencies, have the verified Contract for Difference. These facts are the best proof of IQ Broker credibility in operation.